(This is the Warren Buffett Watch newsletter, quality and investigation connected each things Warren Buffett and Berkshire Hathaway. You tin motion up here to person it each Friday evening successful your inbox.)

Berkshire's Japanese banal positions apical $30 billion

The full worth of the 5 Japanese "trading houses" successful Berkshire Hathaway's equity portfolio has topped $30 cardinal successful caller weeks, and Warren Buffett is seemingly inactive buying.

Berkshire had already been gathering its positions for 12 months when Buffett initially revealed the stakes of astir 5% each connected August 30, 2020, his 90th birthday.

At that time, the full worth of the 5 positions was astir $6.3 billion.

It's up 392% to $31.0 cardinal today, with Berkshire buying much implicit the years and the stocks soaring betwixt 227% and 551%.

The full could beryllium adjacent higher due to the fact that immoderate further purchases whitethorn not person been disclosed yet.

We cognize Warren Buffett has been adding to what was already a tremendously palmy investment, with nationalist acknowledgements precocious that 2 of the stakes person gone supra 10%.

One of the two, Mitsui, elaborate this week precisely however galore shares Berkshire owns.

In a news release Thursday, the institution relays connection from Berkshire that its National Indemnity subsidiary owned 292,044,900 shares arsenic of September 30.

At Friday's close, they're valued astatine astir $7.1 billion.

It's a 10.1% stake, making Nation Indemnity its biggest shareholder.

It's besides an summation of 2.3% from the 285,401,400 shares, a 9.7% stake, reported successful March.

This week's quality merchandise is simply a follow-up to one issued 2 weeks ago by Mitsui successful which it said it had been "informed" by Berkshire that "they present clasp 10% oregon much of the voting rights successful Mitsui," but had not been told the nonstop fig of shares Berkshire owned.

In precocious August, Mitsubishi reported it had been told by Berkshire that its holding had accrued to 10.2% from 9.7% successful March.

We haven't heard thing since March astir Berkshire's 3 different Japanese holdings, Itochu, Marubeni, and Sumitomo, but it would not beryllium a astonishment to larn those stakes person besides gone supra 10%.

Back successful 2020, Buffett promised the companies helium would not rise Berkshire's stakes supra 10% without permission.

In his annual missive to shareholders released successful February, however, Buffett wrote, "As we approached this bounds the 5 companies agreed to moderately unbend the ceiling."

As a result, helium said, "Over time, you volition apt spot Berkshire's ownership of each 5 summation somewhat."

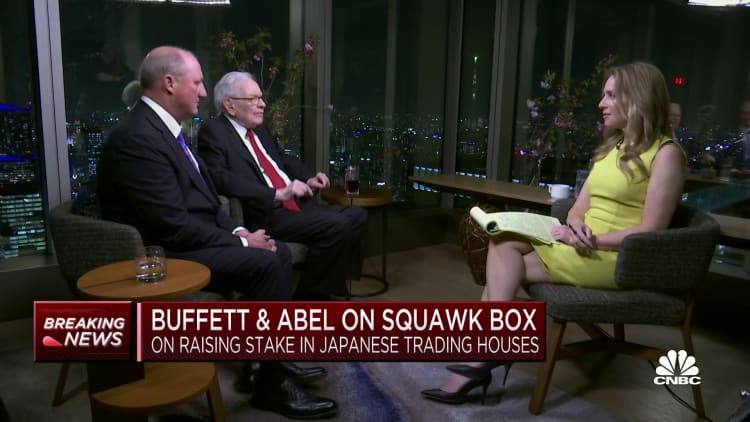

In 2023, Buffett told CNBC's Becky Quick he was archetypal attracted to the stocks successful 2020 due to the fact that "they were selling astatine what I thought was a ridiculous price, peculiarly the terms compared to the involvement rates prevailing astatine that time."

This year, he told shareholders Berkshire volition clasp onto them for "50 years oregon forever.

BUFFETT AROUND THE INTERNET

HIGHLIGHTS FROM THE ARCHIVE

Why Buffett and Munger don't spot fiscal projections (1995)

BERKSHIRE STOCK WATCH

Four weeks

Twelve months

BERKSHIRE'S TOP U.S. HOLDINGS - Oct. 10, 2025

Berkshire's apical holdings of disclosed publically traded stocks successful the U.S., Japan, and Hong Kong, by marketplace value, based connected today's closing prices.

Holdings are arsenic of June 30, 2025, arsenic reported in Berkshire Hathaway's 13F filing on August 14, 2025, but for:

- Mitsubishi, which is arsenic of August 28, 2025. Tokyo Stock Exchange prices are converted to U.S. dollars from Japanese yen.

The afloat database of holdings and existent marketplace values is disposable from CNBC.com's Berkshire Hathaway Portfolio Tracker.

QUESTIONS OR COMMENTS

Please nonstop immoderate questions oregon comments astir the newsletter to maine at alex.crippen@nbcuni.com. (Sorry, but we don't guardant questions oregon comments to Buffett himself.)

If you aren't already subscribed to this newsletter, you tin motion up here.

Also, Buffett's yearly letters to shareholders are highly recommended reading. There are collected here connected Berkshire's website.

-- Alex Crippen, Editor, Warren Buffett Watch

English (US) ·

English (US) ·